Social Security login - An Overview

Wiki Article

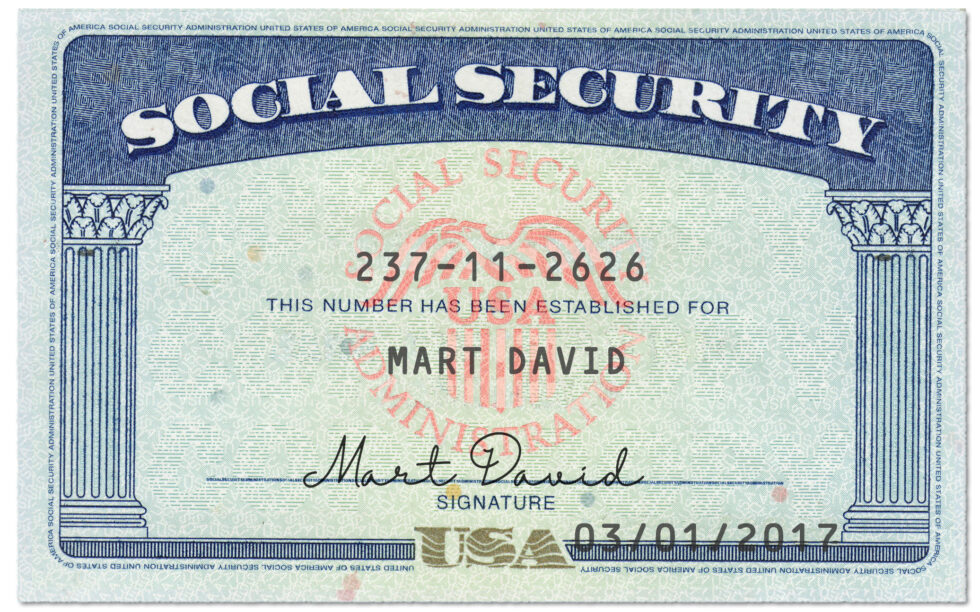

The consumer can create his/her copyright by providing input to several of the fundamental options. These include things like credit card range, SSN, CVV, or maybe the tackle’s postal code.

Regular in additional Functioning several years. Social Security Added benefits are now depending on an average of the employee's 35 maximum paid once-a-year salaries with zeros averaged in if you will find fewer than 35 several years of coated wages.

If you created a Social Security username greater than 3 many years back, you have got to changeover to a completely new or present Login.gov account or use an ID.me account to get ongoing entry to our on-line companies. For move-by-stage instructions regarding how to make the transition, view this online video.

Utilizing a social security amount generator to generate a fake or random social security number won't offer any complete privateness defense.

Scammers may possibly simply call, e mail, textual content, publish, or message you on social media claiming to get from the Social Security Administration or maybe the Business with the Inspector Typical. They might utilize the title of the one who really performs there and may possibly send an image or attachment as “evidence.”

Notify the three big credit bureaus: Equifax, Experian, and TransUnion to include a fraud warn to your credit rating report.

There exists an application price of $24 for mailed programs and $22 for online purposes irrespective of When the Social Security Variety is thought, and it's essential to provide the individual's full title, date, and put of delivery, and names of mother and father. If you have a Social Security Quantity from household records or possibly a Loss of life certification but are unable to locate the person from the SSDI, then it's strongly instructed you involve proof of death with your software, as it'll likely be returned for you if not with that request.

The retirement Gains software procedure follows these general measures, whether or not you apply on-line, by cellular phone, or in human being:

Also, take into account that Falsifying info on an employer’s I-nine type, which include supplying a Bogus social security number, can perhaps result in prices as well as a conviction for civil document fraud.

Nearly everyone is a potential target. The click here Social Security Administration sends checks to over 70 million beneficiaries, which includes retirees and disabled men and women, totaling nearly $120 billion each month.

Resulting from modifying desires or own preferences, somebody might go back to do the job immediately after retiring. In this instance, it can be done to have Social Security retirement or survivors Rewards and perform at the same time. A worker who is of total retirement age or more mature may possibly (with husband or wife) hold all Positive aspects, soon after taxes, irrespective of earnings. But, if this worker or perhaps the employee's wife or husband are youthful than complete retirement age and receiving Gains and gain "an excessive amount", the advantages might be minimized. If working under whole retirement age for the entire calendar year and acquiring Gains, SSA deducts $one with the worker's gain payments for every $2 acquired higher than the yearly limit of $fifteen,120 (2013). Deductions stop when the advantages are already lessened to zero plus the worker can get yet one more 12 months of income and age credit, a little bit raising long term Rewards at retirement.

June 22, 2021 9:26AM Hi Margaret, many thanks for permitting us know. You hung up and didn’t give added details which can be what we convey to persons to complete. When you’re nevertheless anxious, take a look at our Usually Questioned Inquiries on techniques to safeguard yourself. We hope this aids.

We’re dedicated to utilizing the greatest technologies available to protect your own details; further security actions maintain you Protected and secure.

Originally the benefits received by retirees were not taxed as revenue. Commencing in tax 12 months 1984, with the Reagan-period reforms to restore the technique's projected insolvency, retirees with incomes around $25,000 (in the case of married individuals submitting independently who didn't live with the husband or wife at any time throughout the year, and for folks submitting as "single"), or with blended incomes about $32,000 (if married submitting jointly) or, in sure situations, any income amount (if married filing individually through the spouse within a 12 months through which the taxpayer lived Using the spouse Anytime) usually noticed Portion of read more the retiree benefits topic to federal earnings tax.